While contract-dated transaction data from August 12–19 may be pending, now’s a great opportunity to spotlight what’s happening in the Government Land Sales (GLS) space during this period. The URA and MND have firmly positioned the 2H2025 GLS Programme as a significant housing supply driver into next year, rolling out several high-profile private residential and EC sites. Let’s break down key developments that will shape Singapore’s property market moving forward.

2H2025 Confirmed List: A Continued Push on Housing Supply

The second half-2025 GLS Confirmed List remains robust, releasing 4,725 private residential units, including 990 Executive Condominium (EC) units — taking EC supply for the year to the highest levels since 2014 Ministry of National DevelopmentCBRE.

Key highlights include:

| Location | Estimated Units | Type |

| Bukit Timah Road | 340 | Private residential |

| Bedok Rise | 380 | Private residential |

| Woodlands Drive 17 | 560 | EC |

| Dairy Farm Walk | 500 | Private residential |

| Dover Road | 625 | Private + commercial |

| Tanjong Rhu Road | 525 | Private residential |

| Dunearn Road | 335 | Private + retail |

| Kallang Avenue | 450 | Private + retail |

| Lentor Central | 580 | Private residential |

| Miltonia Close | 430 | EC |

CBREMinistry of National Development

This diverse mix of central and suburban, private and EC sites underscores the government’s intention to sustain housing demand, support affordability, and ensure a steady pipeline for developers.

Strategic Context: Why This Matters

- Supply Stabilization: By releasing close to 4,725 confirmed units in 2H2025, the government maintains a consistent housing pipeline, ensuring market stability and meeting demand across price segments Ministry of National DevelopmentCBRE.

- EC Demand Meets Supply: With 990 EC units added to the pipeline, the shift clearly acknowledges local demand from those seeking near-private alternatives Ministry of National Development.

- Geographic Spread, Stakeholder Appeal:

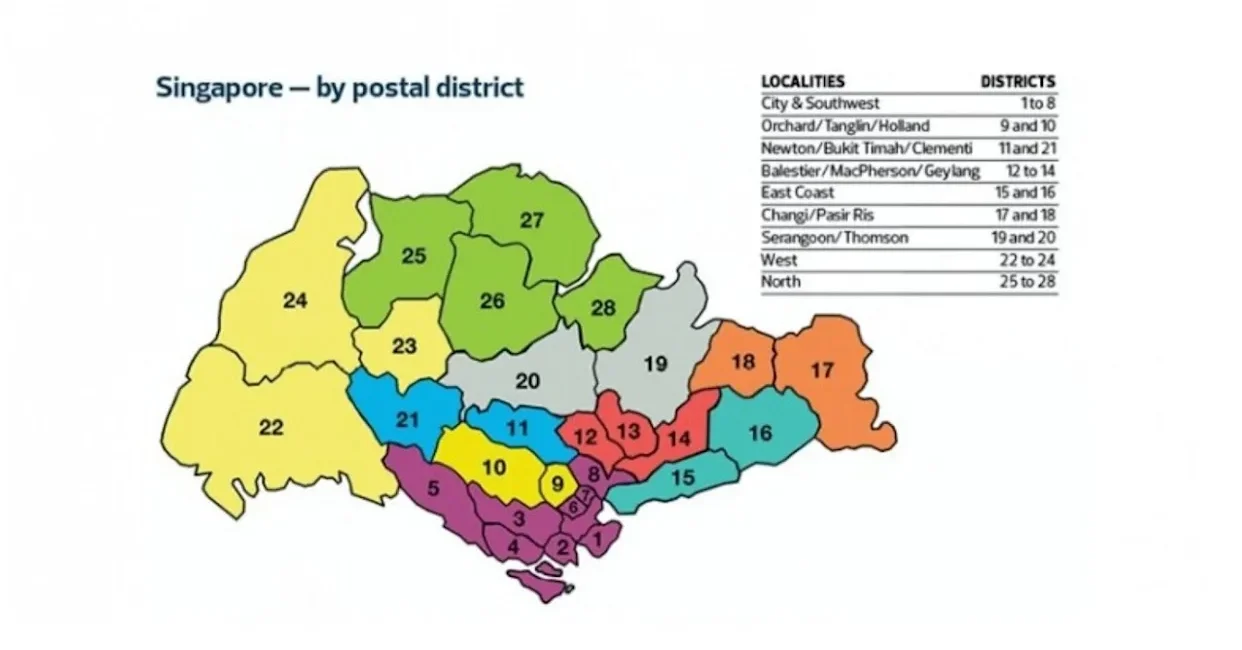

- CCR (Central): Bukit Timah Road, Dover Road, Kallang Avenue — appeals to capital appreciation and central-location buyers.

- OCR/RCR (Suburban): Bedok Rise, Lentor Central, Dairy Farm Walk — supports families and maintain “affordable” options in growth areas.

- EC Hotspots: Woodlands Drive 17 and Miltonia Close address family-owner demand in the North.

- Mixed-Use, Future Ready: Dover Road includes commercial space (3,000 sqm), while Dunearn and Kallang Avenue have associated retail — indicating urban planning alignment with live-work-play trends CBREMinistry of National Development.

What’s Next?

- Bukit Timah Road: Launched for tender in late August 2025 — this prime CCR site, just next to Newton MRT, offers 340 units and is drawing developer attention for bridging central convenience with family-oriented locale Urban Redevelopment AuthorityCBRE.

- Future Site Launches Timeline:

- Bedok Rise: Expected September 2025

- Woodlands Drive 17: October 2025

- Dover Road, Tanjong Rhu, Dairy Farm: November 2025

- Dunearn, Kallang Ave, Lentor Central, Miltonia Close: December 2025 CBREMinistry of National Development.

Developers and potential buyers should track tender results closely. Pricing discovered here often sets benchmarks for new launch prices and priorities investor sentiment.

Why the Mid-Aug Period is Strategic

Even though “done deals” for contracts dated August 12–19 aren’t released yet, sharing a GLS update now ensures:

- Forward-Looking Insights — Provides market watchers and buyers early visibility of upcoming launches.

- Strategic Planning — Enables developers to assess competition, and buyers to expect pricing trends.

- Balanced Perspective — Offsets done-deals chatter with longer-term supply foundations.

Summary

- The 2H2025 GLS Confirmed List positions 4,725 private residential units — including 990 EC units — into the market pipeline Ministry of National DevelopmentCBRE.

- Key sites span across central and suburban locations, with a mix of private, EC, and mixed-use designations.

- Bukit Timah Road site is already live for tender; more sites are slated through November and December 2025.

- This mid-Aug period signals steady future supply, affordability calibration, and opportunity for savvy plant-taking.