Introduction: Dormitory Demand Signals Market Pressure

In the first half of 2025, Singapore’s worker dormitories reached near-full occupancy, while bed rents surged 81.5% compared to pre-pandemic levels. This sharp increase highlights the mounting pressure on accommodation supply for migrant workers, who form the backbone of Singapore’s construction, shipyard, and manufacturing industries.

The Dormitory Crunch: Key Factors Driving Demand

Several elements explain why dormitories are under immense pressure:

- Post-pandemic recovery has brought a surge in construction and infrastructure projects.

- Major GLS launches in housing and mixed-use sites require significant manpower.

- Labour-intensive industries continue to rely heavily on migrant workers.

- Limited new dormitory supply has pushed existing facilities to near capacity.

Impact on GLS & Land Allocation

The worker dorm crisis ties closely to Government Land Sales strategy in 2025:

- Integrated Planning: Future GLS sites may reserve land for worker housing within or near industrial estates.

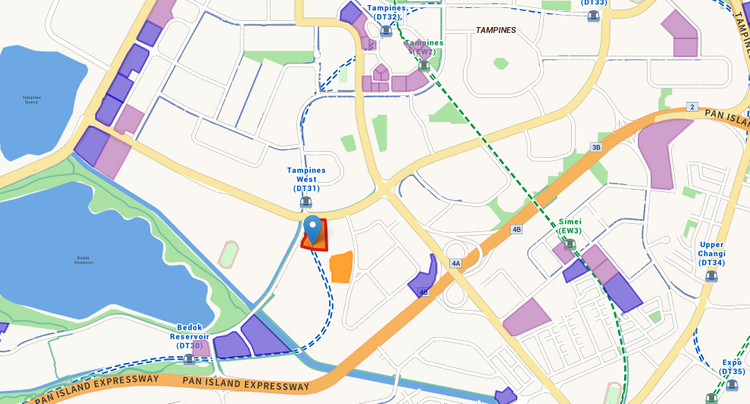

- Location Strategy: Sites near key growth corridors (Jurong, Changi, Tuas) may see dedicated dormitory parcels released.

- Mixed-use Concepts: Authorities could explore integrating industrial, logistics, and worker dorms into single GLS developments.

- Price Pressures: Rising accommodation costs may indirectly push construction and housing costs higher, influencing GLS bidding strategies.

Rising Bed Rents: Ripple Effect on Market

The 81.5% surge in dorm rents is not just a dormitory issue – it affects the broader property market:

- Developers’ Costs: Higher worker accommodation costs increase construction overheads, impacting GLS project feasibility.

- Housing Prices: Rising build costs may translate into higher launch prices for GLS residential projects.

- Labour Retention: Affordable housing for workers is crucial to sustain a steady labour supply for major GLS projects.

Policy & Sustainability Responses

To address the dormitory crunch and align with GLS planning, authorities may consider:

- Releasing dedicated GLS parcels for dormitory development.

- Encouraging public-private partnerships (PPPs) to accelerate supply.

- Upgrading existing dorms with higher density, but better living standards.

- Leveraging modular and prefabricated dormitory solutions on GLS land.

Long-Term Urban Development Perspective

Singapore’s land scarcity requires careful balancing between:

- Residential demand (HDB & private housing).

- Commercial & industrial hubs.

- Worker housing needs.

The worker dorm crunch underlines why GLS remains central to Singapore’s growth model—not only for homes and offices but also for ensuring the support infrastructure behind the property market.

Conclusion: Aligning Dorm Demand with GLS Strategy

The near-full dorm occupancy and 81.5% rent surge in 1H2025 send a clear signal: Singapore must act decisively to ensure worker housing keeps pace with economic growth.

By integrating dormitory planning into GLS, Singapore can manage rising demand while sustaining its urban development pipeline. The Pulau Tekong polder expansion, upcoming GLS launches, and strategic land use planning together will play a vital role in shaping a resilient and inclusive property market.