1. Introduction to GLS 2025 Programme

The Government Land Sales (GLS) Programme is a cornerstone of Singapore’s urban planning strategy, facilitating the development of residential, commercial, and mixed-use projects across the island. In the second half of 2025 (2H2025), the Urban Redevelopment Authority (URA) has released 10 confirmed sites under the GLS programme, projected to yield approximately 4,725 private residential units, including executive condominiums (ECs) and mixed-use developments 99.co.

2. Breakdown of GLS 2H2025 Confirmed Sites

The 10 confirmed GLS sites for 2H2025 encompass a diverse range of developments:

- Executive Condominiums (ECs): Two EC sites are included, contributing to the government's efforts to provide affordable private housing options for Singaporean citizens.

- Mixed-Use Developments: Three sites designated for mixed-use developments, integrating residential units with commercial components to create vibrant, self-sustaining communities.

- Residential-Only Developments: The remaining sites are focused solely on residential developments, catering to the growing demand for private housing in various regions.

These sites are strategically located across Singapore, ensuring a balanced distribution of new housing options to meet the diverse needs of residents.

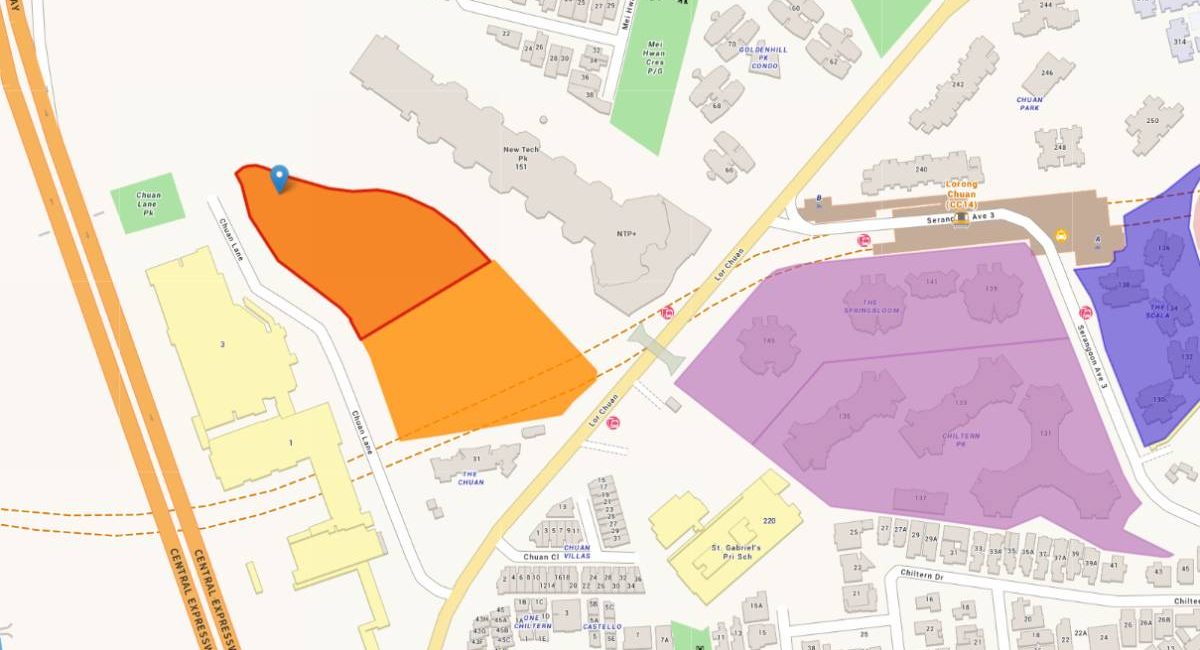

3. Notable GLS Sites and Their Potential

Among the 10 confirmed sites, several stand out due to their strategic locations and development potential:

- Bedok Rise: This site is slated to yield approximately 380 residential units, contributing to the revitalization of the Bedok planning area and enhancing its appeal as a residential hub The Business Times.

- Cross Street: Located in the Central Business District (CBD), this site offers the opportunity to develop a mixed-use project that integrates residential living with commercial spaces, catering to professionals seeking proximity to their workplace.

- Lorong Bistari: This site is designated for the development of a Next-Generation Driving Centre, reflecting the government's commitment to modernizing infrastructure and promoting technological advancements in urban planning Urban Redevelopment Authority.

These developments are expected to enhance the livability and vibrancy of their respective areas, providing residents with modern amenities and improved connectivity.

4. Trends Influencing GLS 2025 Developments

Several key trends are shaping the GLS developments in 2025:

- Integration of Smart Technologies: New developments are incorporating smart home features and digital infrastructure to meet the demands of tech-savvy residents.

- Sustainability Initiatives: There is a strong emphasis on green building practices, with many projects aiming for sustainability certifications and incorporating eco-friendly designs.

- Mixed-Use Developments: The trend towards mixed-use developments continues, promoting live-work-play environments that reduce the need for long commutes and enhance community engagement.

- Focus on Affordability: The inclusion of EC sites reflects the government's ongoing efforts to provide affordable private housing options for Singaporean citizens.

These trends align with Singapore's broader goals of creating sustainable, livable, and inclusive communities.

5. Implications for Buyers and Investors

For prospective buyers and investors, the GLS 2H2025 programme presents several opportunities:

- Diverse Housing Options: The variety of developments caters to different preferences and budgets, from affordable ECs to premium mixed-use projects.

- Strategic Locations: Sites in established and emerging neighborhoods offer potential for capital appreciation and rental yields.

- Government Support: The government's active role in land sales and urban planning provides a stable environment for property investments.

However, buyers and investors should also consider factors such as project timelines, developer track records, and market conditions when making decisions.

6. Looking Ahead: Future GLS Programmes

The GLS programme is expected to continue evolving in response to changing demographics, economic conditions, and urban development goals. Future programmes may include more sites designated for affordable housing, further integration of smart technologies, and continued emphasis on sustainability. Staying informed about upcoming GLS releases and market trends will be crucial for making informed property decisions.

7. Conclusion

The GLS 2H2025 programme reflects Singapore's commitment to meeting the housing needs of its residents through strategic land sales and thoughtful urban planning. With a diverse range of developments across various regions, the programme offers opportunities for both buyers and investors to find suitable properties that align with their preferences and goals. As the urban landscape continues to evolve, staying informed about GLS releases and market trends will be essential for navigating Singapore's dynamic property market.