Introduction

Singapore’s Government Land Sales (GLS) programme remains a central pillar in managing land supply for housing, commercial, and hospitality sectors. The 2H 2025 GLS release underscores the government’s commitment to ensuring steady, well-balanced land supply amid shifting market dynamics.

Key Highlights from 2H 2025 GLS

- Confirmed List: 10 residential sites (including two EC plots) yielding 4,725 private units, of which 990 are Executive Condominium (EC) units — the highest EC supply since 2014. Urban Redevelopment Authoritypropnex.comERA

- Reserve List: 12 sites offering an additional 4,475 residential units, plus 173,800 sqm of commercial space and 880 hotel rooms. Urban Redevelopment Authoritypropnex.com

- Total GLS Pipeline for 2025:

- Private Housing: ~9,800 units

- Pipeline (incl. approved sites): ~56,700 units Urban Redevelopment Authoritymnd.gov.sgpropnex.com

- Supply Adjustment: Confirmed supply dipped ~6% quarter-on-quarter, while Reserve List supply went up by ~29%, offering more flexibility. CBRE

What’s on Offer—Top Sites to Watch

Prime Confirmed List Sites:

- Bukit Timah Road — ~340 units near Newton MRT interchange

- Woodlands Drive 17 (EC) — ~560 EC units near Woodlands South MRT

- Dover Road (Mixed Use) — ~625 units plus ~3,000 sqm commercial space

- Kallang Avenue — ~450 units near Kallang River and Kallang MRT

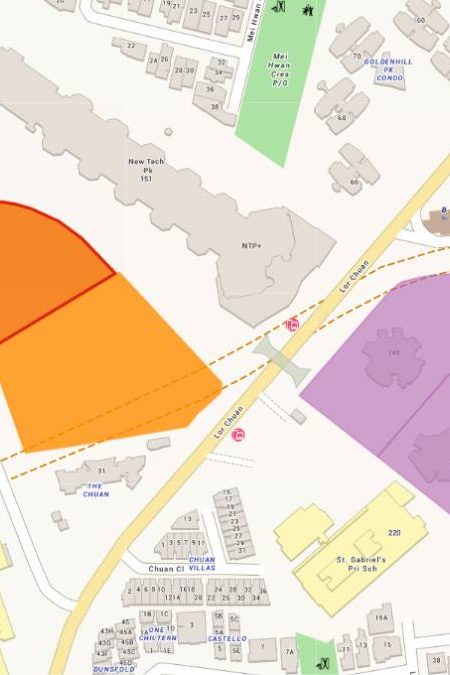

- Other areas: Bedok Rise, Dairy Farm Walk, Dunearn Road, Tanjong Rhu, Lentor Central, Miltonia Close (EC) Urban Redevelopment AuthorityRipton Realty Pte LtdERA

Reserve List Opportunities:

- Marina Gardens Lane

- Media Circle (Parcel A & B)

- River Valley Green (Parcel C)

- Holland Plain

- Cross Street (residential, SA2)

- Telok Ayer Street (hotel mixed-use) Urban Redevelopment AuthorityCBREpropnex.comProperties pot

These sites offer a spread across prime and growth areas, blending housing with lifestyle, office and hotel uses.

Market Implications

- Housing Stability: GLS injects much-needed supply, helping moderate private home price increases that have eased to ~0.8% in 1Q 2025 compared to higher growth in previous years. Urban Redevelopment Authoritymnd.gov.sg

- EC Demand Spotlights: Record EC supply via GLS (nearly 2,000 units in 2025) reflects strong upgrader and hybrid buyer interest. Urban Redevelopment Authoritypropnex.com

- Commercial & Hotel Boost: Office and mixed-use sites are positioned to support decentralised growth and tourism sector needs—e.g., Cross Street, Telok Ayer. Urban Redevelopment AuthorityCBRE

- Strategic Flexibility: The Reserve List gives developers optionality to launch only if demand conditions align.

What Buyers & Developers Should Watch

- Developers: Focus on bidding for mature towns (Bukit Timah, ECs) for assured demand, while keeping an eye on emerging commercial or mixed-use sites for differentiation.

- Buyers / Investors: Monitor scheduled GLS tenders to anticipate launch timelines and potential price trends, particularly for ECs and central residential corridors.

- Urban Planners: The diversified pipeline supports long-term urban strategy—balancing housing needs, decentralisation, and commercial vibrancy.

Conclusion

The 2H 2025 GLS update showcases Singapore’s careful land supply strategy—delivering nearly 10,000 housing units, a record EC pipeline, and expanding commercial and hotel land to reflect evolving urban needs. This measured approach aims to sustain market stability while adapting to dynamic demand trends—and offers developers, buyers, and investors clarity and opportunity.