Introduction

Singapore’s Government Land Sales (GLS) Programme continues to play a critical role in shaping the property market. With rising housing demand, evolving buyer expectations, and developer appetite for prime locations, the GLS programme for 2025 has introduced several key land parcels across residential, commercial, and mixed-use categories.

The latest GLS updates highlight the government’s commitment to balanced housing supply, urban renewal, and sustainable growth in line with Singapore’s long-term development strategy.

1. What is the GLS Programme?

The Government Land Sales (GLS) Programme is a land allocation system through which the Singapore government releases state land for development. Key objectives include:

- Ensuring sufficient housing supply to meet demand.

- Maintaining affordability by preventing land shortages.

- Strategic urban planning, ensuring land use is aligned with Singapore’s future vision.

- Encouraging competition among developers for prime land parcels.

2. Latest GLS Updates for 2025

The 2025 GLS programme reflects strong government measures to tackle rising demand for housing while maintaining sustainability.

- Residential Sites: More than 10,000 potential housing units are expected to come from confirmed and reserve list sites.

- Mixed-Use Developments: Focus on integrating residential with retail and commercial spaces to promote vibrant urban hubs.

- Commercial Land Parcels: New commercial sites near MRT hubs and business districts to support decentralization.

- Green Initiatives: Preference for developers integrating energy-efficient, eco-friendly designs in bids.

3. Confirmed List vs Reserve List Sites

The GLS programme is divided into two categories:

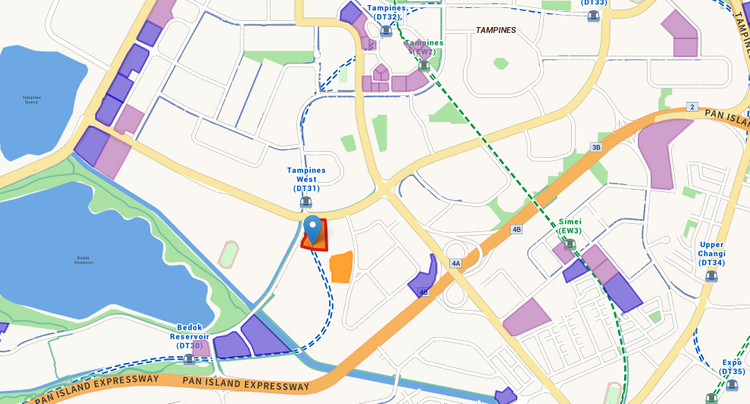

- Confirmed List: Land parcels launched regardless of demand. These usually target high-demand areas like Tampines, Jurong Lake District, and Tengah.

- Reserve List: Sites launched only if developers show sufficient interest. This helps maintain flexibility in land supply.

In 2025, confirmed list supply has been scaled up to ensure the property market remains stable amid growing demand for both private and public housing.

4. Market Trends Shaping GLS Demand

Several trends influence how developers approach GLS sites:

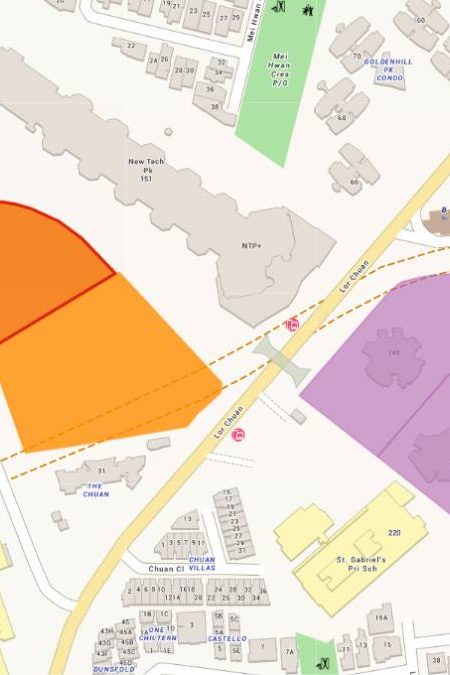

- Strong demand for suburban housing: With rising HDB upgraders, OCR (Outside Central Region) sites see aggressive bidding.

- Luxury segment growth: Prime sites in CCR (Core Central Region) continue to attract high-end developers targeting foreign buyers.

- Rising construction costs: Developers are carefully balancing land bid prices against escalating building expenses.

- Rental market surge: Investor interest remains high due to strong rental demand from expatriates and young professionals.

5. Impact on Developers

Developers view GLS as the primary gateway to secure prime development sites. The 2025 programme impacts them in several ways:

- Tighter competition: With fewer prime sites, developers are likely to submit higher and more competitive bids.

- Joint ventures on rise: To share risks, more developers are collaborating on large GLS bids.

- Focus on sustainability: Developers integrating smart technology, green design, and community spaces stand a better chance of winning bids.

6. Impact on Homebuyers & Investors

For buyers and investors, the GLS programme has direct implications:

- More housing supply keeps prices relatively stable.

- New launches in suburban areas provide more affordable options for HDB upgraders.

- Greater variety of mixed-use projects offer convenience and lifestyle-focused living.

- Prime locations continue to see upward pricing but also long-term value appreciation.

7. Recent GLS Highlights

- Jurong Lake District Parcel: A mixed-use site released to further decentralize the CBD and build a new regional hub.

- Tampines Residential Sites: Providing thousands of new homes with proximity to MRTs and schools.

- Tengah Town Expansion: Supports Singapore’s newest HDB town with green, sustainable design features.

- Orchard Road Redevelopment GLS: Injects new vibrancy into the luxury retail and residential corridor.

8. Future Outlook

The GLS programme will continue to be the backbone of Singapore’s property market stability. Looking ahead:

- Supply-side support: More housing sites are expected to keep up with demand.

- Shift toward sustainability: Green housing standards will become the norm in GLS projects.

- Balanced growth: Government will ensure both suburban and prime city areas see controlled development.

- Investment appeal: As foreign investors eye Singapore’s stable market, GLS projects will remain attractive long-term assets.

Conclusion

The 2025 GLS programme underlines Singapore’s commitment to sustainable urban growth, affordable housing, and long-term property market stability. With an increase in residential supply, new mixed-use hubs, and prime commercial parcels, both developers and buyers can look forward to a more diverse property landscape.