The Government Land Sales (GLS) programme is one of Singapore’s most critical tools in regulating housing supply and maintaining market stability. By releasing residential and mixed-use sites through scheduled tenders, the government ensures developers have access to land while balancing affordability for buyers. In 2025, GLS activity remains robust, with prime sites in Orchard, River Valley, and Holland Drive shaping the future of the property market.

1. What is GLS and Why It Matters

The GLS programme, managed by the Urban Redevelopment Authority (URA), makes land available through two lists:

- Confirmed List: Sites released on a fixed schedule for tender.

- Reserve List: Sites released only if developers express strong interest.

Why it matters:

- Sets benchmark prices for future launches.

- Ensures steady housing supply to prevent overheating.

- Influences developer strategies and nearby resale market prices.

2. GLS Market Landscape in 2025

2025’s GLS programme comes on the back of strong housing demand in 2024, with resale and new launch prices climbing despite cooling measures. Developers are cautious but remain active, especially in prime districts.

Key trends:

- Selective bidding: Developers are choosier due to tighter margins from higher construction and borrowing costs.

- Strong demand in prime areas: Orchard Boulevard, River Valley, and Holland Drive sites attract significant attention.

- Balanced supply pipeline: GLS provides stability while avoiding oversupply risks.

3. Major GLS Sites in 2025

Some of the most significant GLS sites shaping the 2025 landscape include:

- Orchard Boulevard (Luxury Segment):

- Prime central site expected to set new benchmarks for high-end condos.

- Likely to attract foreign buyers and investors seeking prestigious addresses.

- River Valley Green (Parcel A):

- Central location near MRT and lifestyle hubs.

- Targeting families and investors with strong rental demand.

- Holland Drive:

- Popular with local upgraders.

- Mid-tier development appealing to families seeking a balance between city and suburb.

- Zion Road:

- Potential for mixed-use development.

- Adds vibrancy to the area while offering both residential and commercial opportunities.

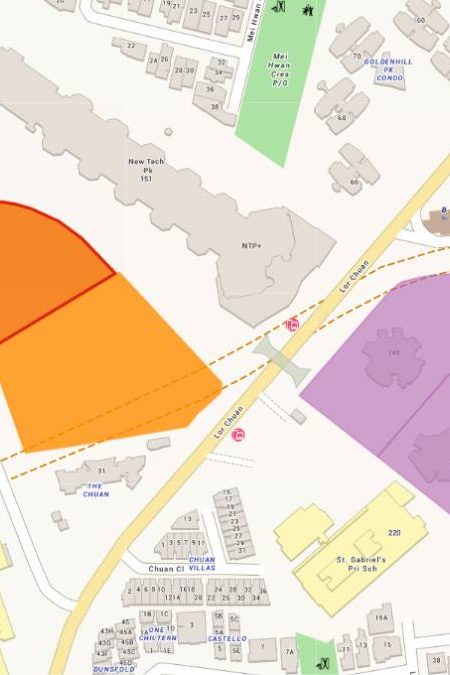

Upcoming Suburban Sites: Tampines, Lentor, and Bukit Batok remain important to provide affordable housing options.

4. How GLS Affects Prices

GLS tender results often set the tone for upcoming launches. For example:

- Higher land bids = higher breakeven costs, pushing launch prices up.

- Competitive bidding = confidence in demand despite cooling measures.

- Lower bids = cautious developer sentiment, signaling market moderation.

2025 outlook: With cautious optimism, analysts expect private property prices to grow 3–5%, supported by GLS supply and healthy demand.

5. Developer Sentiment in 2025

Developers are walking a fine line:

- Rising construction costs and interest rates make profitability tighter.

- Cooling measures like ABSD and tighter LTV ratios limit speculative demand.

- Still, confidence remains—especially in prime sites that guarantee strong demand.

Observation: Smaller developers may partner in joint ventures to reduce risks when bidding for larger parcels.

6. GLS and Housing Supply

The government’s commitment to 55,000 new BTO flats (2025–2027) is complemented by GLS, which fuels private housing supply.

- GLS ensures there’s adequate land for private housing, preventing a squeeze in supply.

- Developers launching GLS projects in 2026–2028 will meet demand from today’s buyers upgrading from HDB resale.

- Locations near MRT lines and growth nodes (e.g., Punggol Digital District, Bayshore) are expected to see strong demand.

7. Impact on Buyers and Investors

- Homebuyers: GLS projects shape the pricing of new launches; buyers should monitor tender results to anticipate affordability.

- Investors: Prime GLS launches often command higher rents; suburban GLS launches provide stable long-term appreciation.

- Upgraders: Million-dollar HDB sellers often eye new suburban GLS projects for value-for-money upgrades.

8. Challenges for GLS in 2025

- High interest rates: Affect developers’ financing and buyer affordability.

- Global uncertainties: Economic slowdown or geopolitical risks may reduce foreign investment appetite.

- Affordability limits: Developers cannot price launches too aggressively as demand is price-sensitive.

Despite these, GLS remains a stabilizing force ensuring a sustainable property market.

9. Long-Term Outlook for GLS

Looking ahead:

- GLS will continue playing a key role in shaping housing supply and balancing prices.

- Developers will remain strategic, bidding cautiously but with strong interest in central and well-connected sites.

- Buyers and investors should track GLS tenders to anticipate price movements in upcoming launches.

Conclusion

The Government Land Sales programme in 2025 underscores Singapore’s proactive approach to real estate management. With prime sites in Orchard, River Valley, Holland, and Zion Road, GLS is shaping the next wave of launches while ensuring supply stability.

For buyers, watching GLS tender results offers insights into future launch prices. For developers, GLS represents both opportunity and challenge in a market moderated by policy measures. Ultimately, GLS keeps Singapore’s property market sustainable, forward-looking, and resilient.